How can I issue invoices in Gekko?

Issuing invoices in Gekko is straightforward and secure. The platform guides you through each step, from verifying your identity to creating compliant invoices that meet all legal requirements.

-

Upload your digital certificate

- To get started, securely upload your digital certificate and enter your password. This step verifies your identity and authorizes you to issue electronic invoices through Gekko.

-

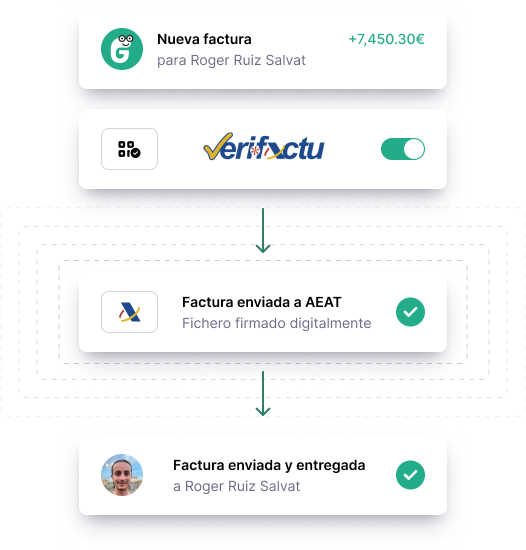

Create Invoice with QR Code

- Generate your invoice easily within Gekko. Each invoice automatically includes a QR code, allowing quick verification by your clients and the Tax Agency.

-

Send and Issue Invoice

- Once your invoice is ready, send it directly to your client and simultaneously issue it to the Tax Agency. This ensures full compliance and real-time reporting.

To whom does it apply?

How will my invoices change?

What happens if I send an incorrect invoice?

Start now with our

free accounting software